omaha nebraska sales tax rate 2020

This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Omaha Nebraska is.

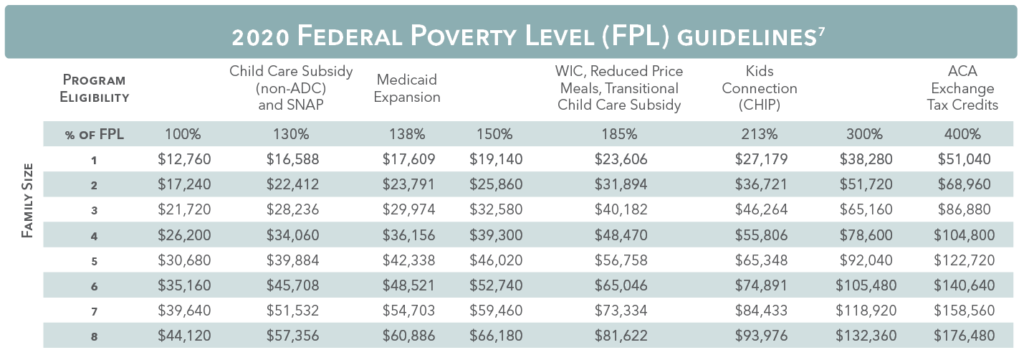

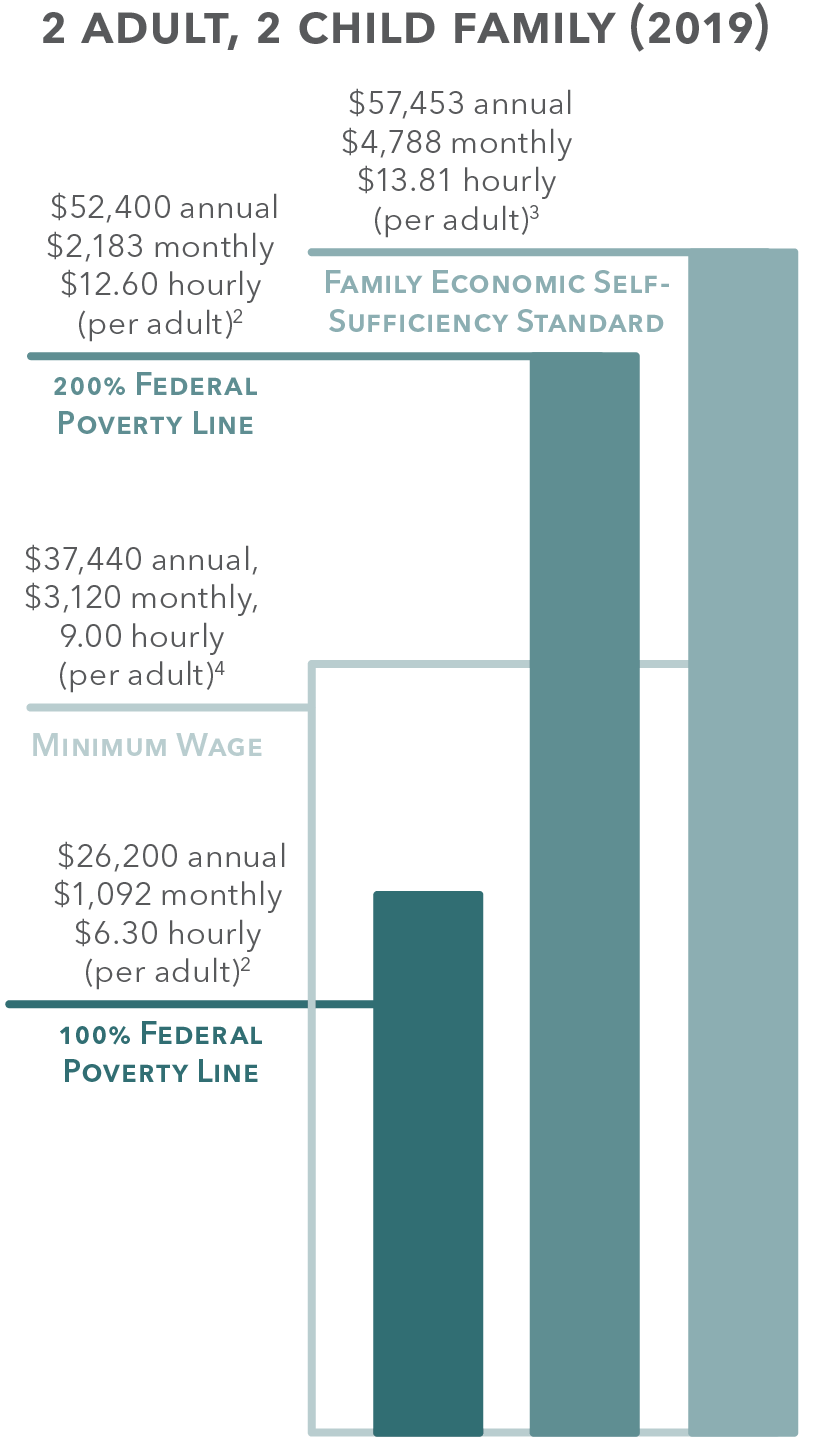

Economic Stability 2020 Kids Count Nebraska

See it in Action.

. Nebraska Income Tax Rate 2020 - 2021. 2020 rates included for use while preparing your income tax deduction. What is the sales tax rate in Omaha Nebraska.

The minimum combined 2022 sales tax rate. Nebraska Income Tax Rate 2020 - 2021. This rate includes any state county city and local sales taxes.

Notification to permitholders of changes in local sales and use tax rates effective october 1 2022 updated 06032022 effective october. You can print a 7 sales tax table here. Omaha Nebraska Sales Tax Rate 2020.

Ad The sales tax information you need listed by individual states and updated in real time. Counties and cities can charge an. The 7 sales tax rate in Omaha consists of 55 Nebraska state sales tax and 15 Omaha tax.

Avalara calculates collects files remits sales tax returns for your business. 2020 rates included for use while preparing your income tax deduction. The minimum combined 2022 sales tax rate for Omaha Nebraska is.

The minimum combined 2022 sales tax rate for omaha nebraska is. Omaha NE Copperfields Homes for Sale from. Omaha Nebraska Sales Tax Rate 2020.

The Nebraska state sales and use tax rate is 55 055. County and city taxes. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

The latest sales tax rate for Omaha NE. Counties and cities can. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated.

Ad Avalara AvaTax Lowers Risk by Automating Sales Tax Compliance. If property taxes sales taxes and income taxes were equalized as sources of state and local revenue property. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax.

Registration fee for farm plated truck and truck tractors is based upon the gross vehicle. The december 2020 total local sales tax rate was also 7000. The minimum combined 2022 sales tax rate for Omaha Nebraska is.

Omaha Nebraska Sales Tax Rate 2020. Groceries are exempt from the Nebraska sales tax. The sales tax rate in Omaha is 7.

6332 Nebraska has state sales tax of 55 and allows local governments. Sellers use our guide to keep current on all nexus laws and the collection of sales tax. Average Sales Tax With Local.

Here are rates for cities around Omaha. The december 2020 total local sales tax rate was also 7000. The latest sales tax rates for cities in Nebraska NE state.

Sale tax rates vary from city to city. There is no applicable county tax or special tax. 2020 rates included for use while.

Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. 2020 rates included for use while preparing your income tax deduction. Nebraska Income Tax Rate 2020 - 2021.

The latest sales tax rate for Omaha NE. Sales Tax Calculator.

General Fund Receipts Nebraska Department Of Revenue

Sales Taxes In The United States Wikipedia

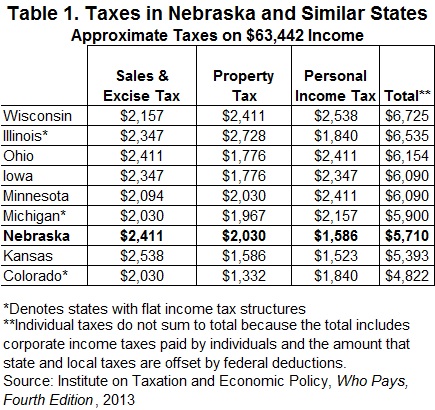

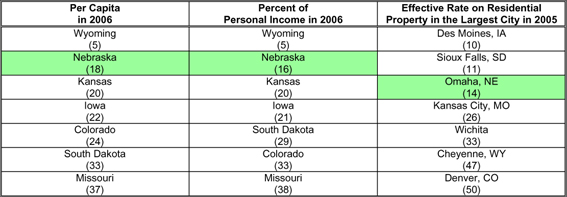

Taxes And Spending In Nebraska

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Nebraska Sales Tax Rates By City County 2022

Nebraska State Tax Software Preparation And E File On Freetaxusa

Sales Taxes In The United States Wikipedia

New Budget Analysis Highlighted Facebook Invests In Nebraska Office Of Governor Pete Ricketts

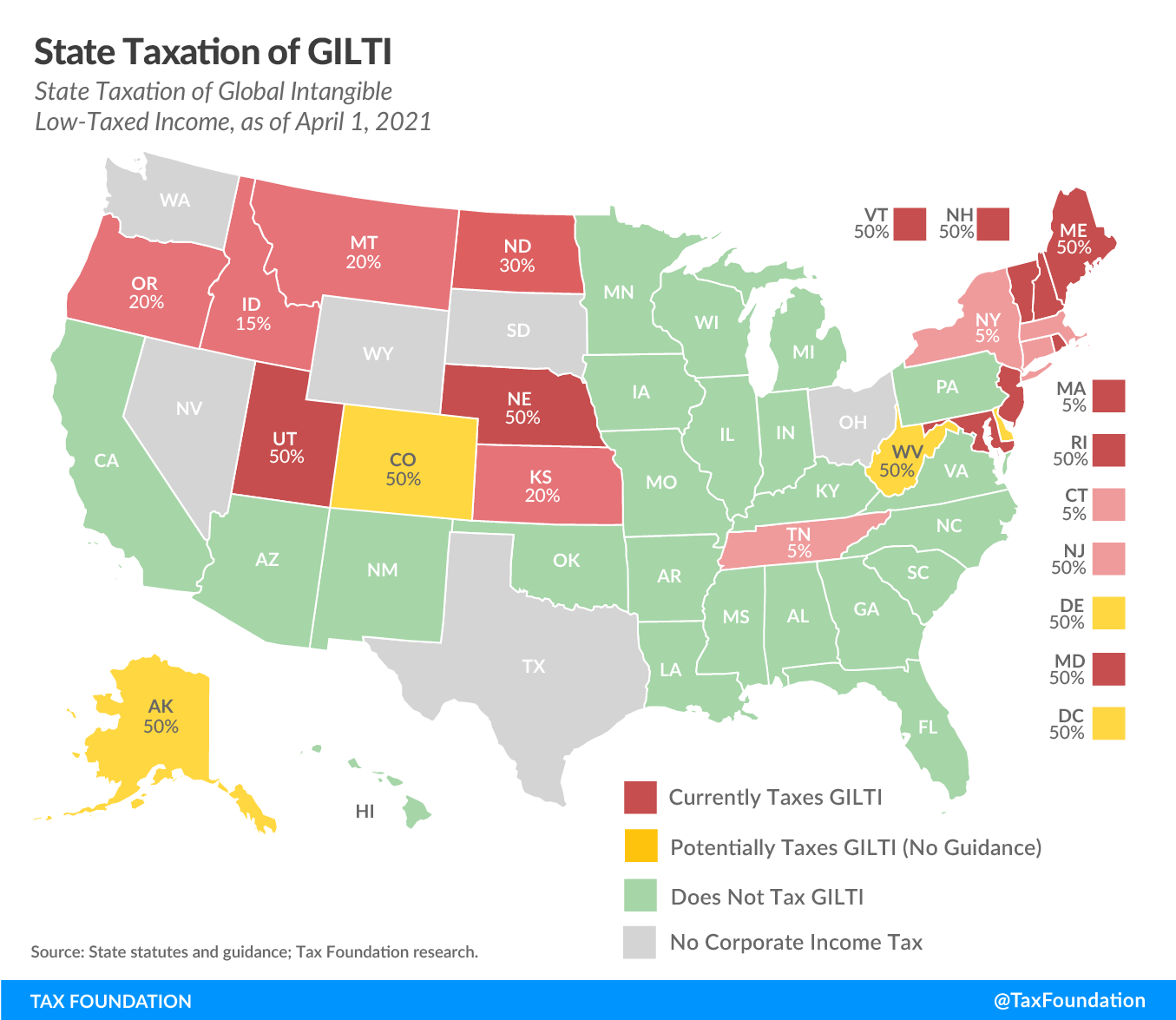

Nebraska Corporate Tax Bill Gilti And Corporate Rate Reduction

Nebraska Ended Fiscal Year With More Revenue Than Expected

Major Bills On Corrections Taxes Headed For Debate Wednesday Nebraska Examiner

Taxes And Spending In Nebraska

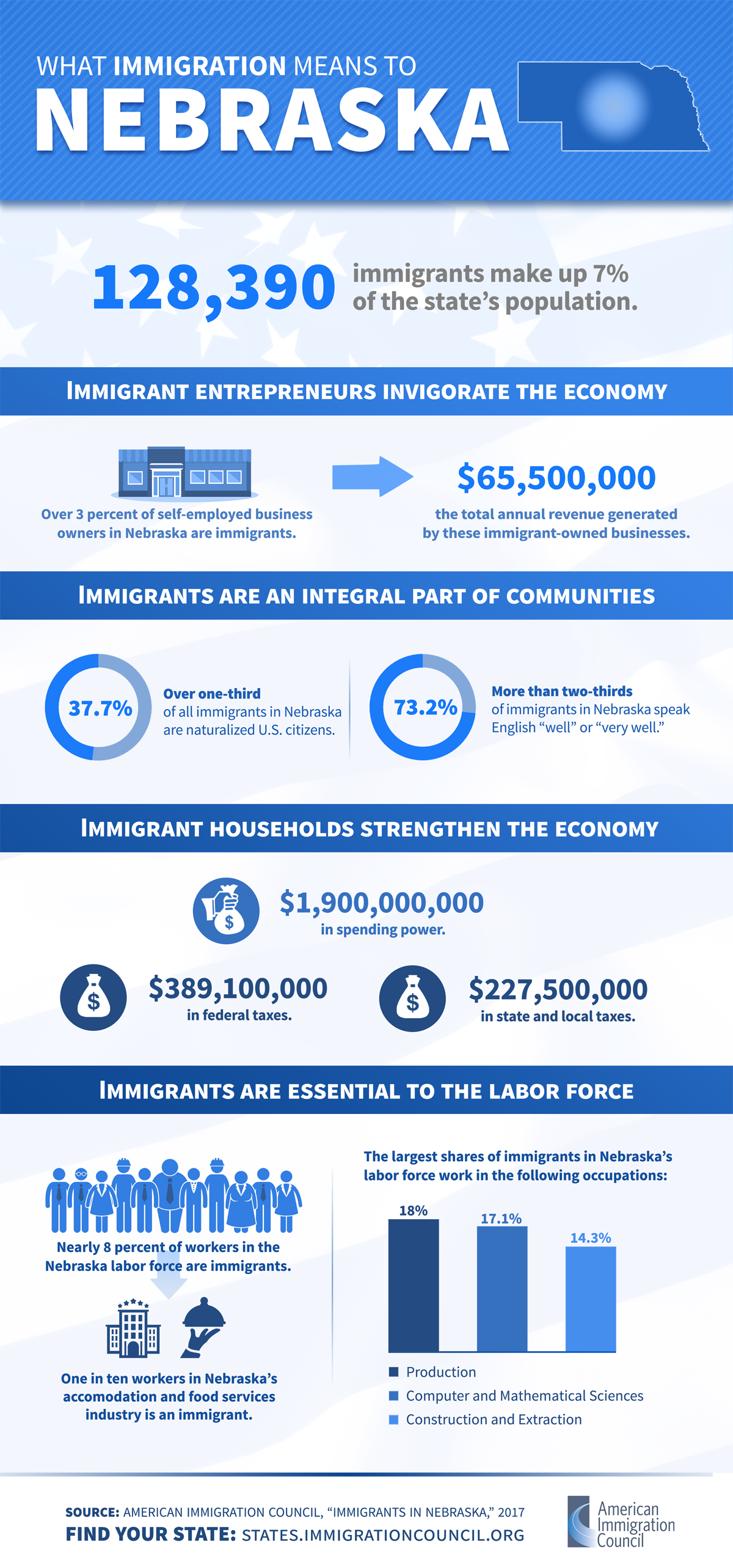

Immigrants In Nebraska American Immigration Council

Economic Stability 2020 Kids Count Nebraska

Home League Of Women Voters Of Greater Omaha

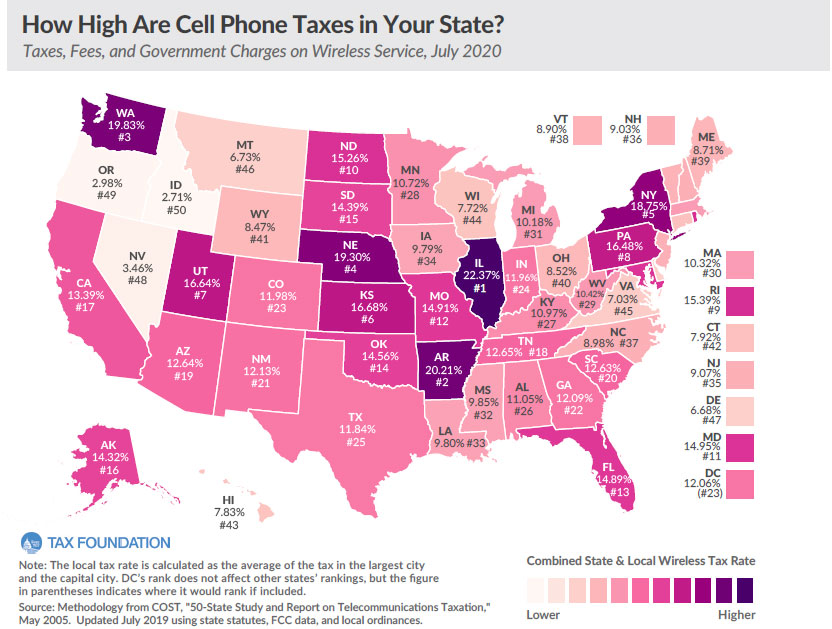

Nebraska Has 4th Highest Wireless Tax Burden In The Nation